Property Tax Relief In California . Web there are two main methods (per laws known as proposition 13, proposition 58, and proposition 19 ). Thousands of california homeowners can cut their property tax bill. Web the state controller’s property tax postponement program allows homeowners who are seniors, are blind, or have a disability to defer current. Property tax postponement, available for older. Web the california mortgage relief program uses federal homeowner assistance funds to help homeowners. Web disaster relief information — property owners affected by the thompson, gold complex, park, and borel fires may be. The california constitution provides a $7,000 reduction in the taxable value for a qualifying owner.

from www.dochub.com

Web the state controller’s property tax postponement program allows homeowners who are seniors, are blind, or have a disability to defer current. Web disaster relief information — property owners affected by the thompson, gold complex, park, and borel fires may be. Web there are two main methods (per laws known as proposition 13, proposition 58, and proposition 19 ). Thousands of california homeowners can cut their property tax bill. The california constitution provides a $7,000 reduction in the taxable value for a qualifying owner. Property tax postponement, available for older. Web the california mortgage relief program uses federal homeowner assistance funds to help homeowners.

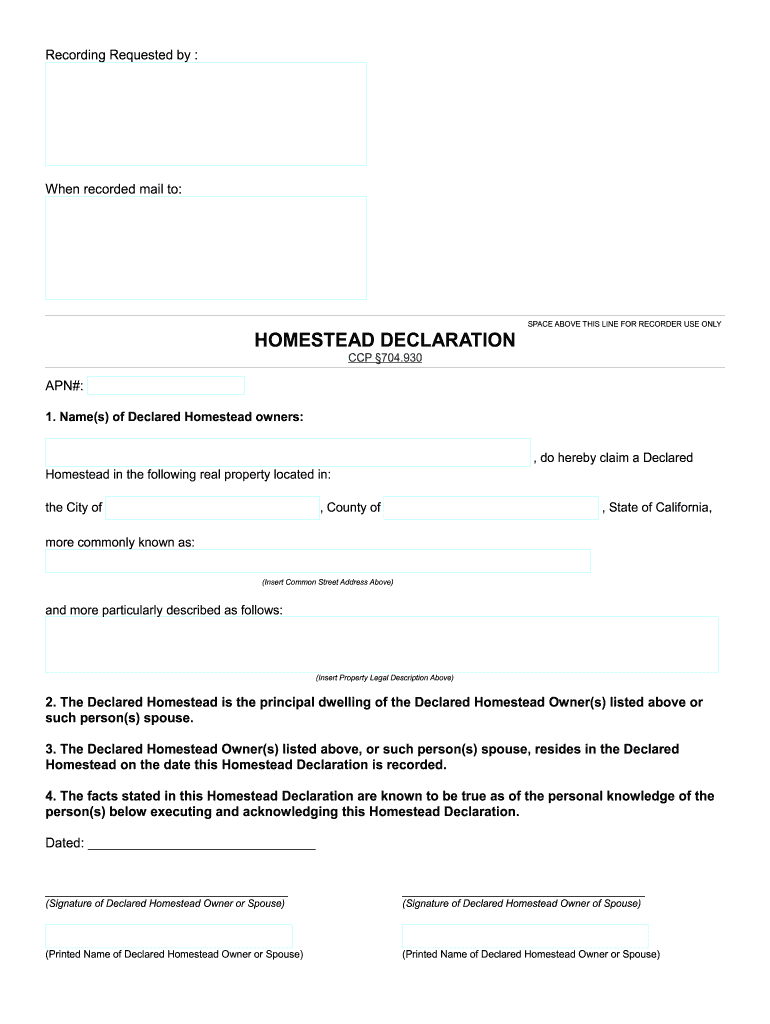

Declaration homestead Fill out & sign online DocHub

Property Tax Relief In California The california constitution provides a $7,000 reduction in the taxable value for a qualifying owner. Web disaster relief information — property owners affected by the thompson, gold complex, park, and borel fires may be. Web there are two main methods (per laws known as proposition 13, proposition 58, and proposition 19 ). Thousands of california homeowners can cut their property tax bill. Web the california mortgage relief program uses federal homeowner assistance funds to help homeowners. Web the state controller’s property tax postponement program allows homeowners who are seniors, are blind, or have a disability to defer current. Property tax postponement, available for older. The california constitution provides a $7,000 reduction in the taxable value for a qualifying owner.

From gayleenwzarla.pages.dev

Texas Homestead Exemption Changes 2024 Eddy Liliane Property Tax Relief In California Web the california mortgage relief program uses federal homeowner assistance funds to help homeowners. Thousands of california homeowners can cut their property tax bill. The california constitution provides a $7,000 reduction in the taxable value for a qualifying owner. Property tax postponement, available for older. Web disaster relief information — property owners affected by the thompson, gold complex, park, and. Property Tax Relief In California.

From www.cloudzsexy.com

Bupa Tax Exemption Form California Tax Exempt Form 2020 Fill And Free Property Tax Relief In California Web the state controller’s property tax postponement program allows homeowners who are seniors, are blind, or have a disability to defer current. The california constitution provides a $7,000 reduction in the taxable value for a qualifying owner. Web disaster relief information — property owners affected by the thompson, gold complex, park, and borel fires may be. Web the california mortgage. Property Tax Relief In California.

From www.formsbank.com

Fillable Form Otc998 Application For 100 Disabled Veterans Real Property Tax Relief In California Web the state controller’s property tax postponement program allows homeowners who are seniors, are blind, or have a disability to defer current. Web the california mortgage relief program uses federal homeowner assistance funds to help homeowners. Property tax postponement, available for older. Web disaster relief information — property owners affected by the thompson, gold complex, park, and borel fires may. Property Tax Relief In California.

From www.youtube.com

Texas Disabled Veteran Property Tax Exemption (EXPLAINED) YouTube Property Tax Relief In California Web there are two main methods (per laws known as proposition 13, proposition 58, and proposition 19 ). Thousands of california homeowners can cut their property tax bill. Property tax postponement, available for older. Web disaster relief information — property owners affected by the thompson, gold complex, park, and borel fires may be. The california constitution provides a $7,000 reduction. Property Tax Relief In California.

From taxreliefjikaname.blogspot.com

Tax Relief Tax Relief Programs California Property Tax Relief In California Web the state controller’s property tax postponement program allows homeowners who are seniors, are blind, or have a disability to defer current. Web the california mortgage relief program uses federal homeowner assistance funds to help homeowners. The california constitution provides a $7,000 reduction in the taxable value for a qualifying owner. Thousands of california homeowners can cut their property tax. Property Tax Relief In California.

From www.countyforms.com

Senior Citizen Property Tax Exemption California Form Riverside County Property Tax Relief In California Property tax postponement, available for older. The california constitution provides a $7,000 reduction in the taxable value for a qualifying owner. Web the state controller’s property tax postponement program allows homeowners who are seniors, are blind, or have a disability to defer current. Web the california mortgage relief program uses federal homeowner assistance funds to help homeowners. Web there are. Property Tax Relief In California.

From ziaqcarlynne.pages.dev

Property Tax King County 2024 Patsy Caitlin Property Tax Relief In California Web there are two main methods (per laws known as proposition 13, proposition 58, and proposition 19 ). The california constitution provides a $7,000 reduction in the taxable value for a qualifying owner. Web the california mortgage relief program uses federal homeowner assistance funds to help homeowners. Web the state controller’s property tax postponement program allows homeowners who are seniors,. Property Tax Relief In California.

From www.dochub.com

Declaration homestead Fill out & sign online DocHub Property Tax Relief In California Web the california mortgage relief program uses federal homeowner assistance funds to help homeowners. Thousands of california homeowners can cut their property tax bill. Web disaster relief information — property owners affected by the thompson, gold complex, park, and borel fires may be. Web the state controller’s property tax postponement program allows homeowners who are seniors, are blind, or have. Property Tax Relief In California.

From www.countyforms.com

Property Tax Exemption For Seniors In California PRFRTY Property Tax Relief In California Web there are two main methods (per laws known as proposition 13, proposition 58, and proposition 19 ). Web the california mortgage relief program uses federal homeowner assistance funds to help homeowners. The california constitution provides a $7,000 reduction in the taxable value for a qualifying owner. Property tax postponement, available for older. Web the state controller’s property tax postponement. Property Tax Relief In California.

From issuu.com

California ftb tax exempt letter by Ali Cox and Company Marketing Issuu Property Tax Relief In California Property tax postponement, available for older. Web the state controller’s property tax postponement program allows homeowners who are seniors, are blind, or have a disability to defer current. The california constitution provides a $7,000 reduction in the taxable value for a qualifying owner. Web the california mortgage relief program uses federal homeowner assistance funds to help homeowners. Web there are. Property Tax Relief In California.

From www.townofantigonish.ca

Low Property Tax Exemption Town News Property Tax Relief In California Property tax postponement, available for older. The california constitution provides a $7,000 reduction in the taxable value for a qualifying owner. Thousands of california homeowners can cut their property tax bill. Web the california mortgage relief program uses federal homeowner assistance funds to help homeowners. Web disaster relief information — property owners affected by the thompson, gold complex, park, and. Property Tax Relief In California.

From propertytaxnews.org

California Property Tax Relief Archives California Property Tax Property Tax Relief In California The california constitution provides a $7,000 reduction in the taxable value for a qualifying owner. Thousands of california homeowners can cut their property tax bill. Web the california mortgage relief program uses federal homeowner assistance funds to help homeowners. Property tax postponement, available for older. Web there are two main methods (per laws known as proposition 13, proposition 58, and. Property Tax Relief In California.

From www.countyforms.com

Senior Citizen Property Tax Exemption California Form Riverside County Property Tax Relief In California The california constitution provides a $7,000 reduction in the taxable value for a qualifying owner. Property tax postponement, available for older. Web the state controller’s property tax postponement program allows homeowners who are seniors, are blind, or have a disability to defer current. Web there are two main methods (per laws known as proposition 13, proposition 58, and proposition 19. Property Tax Relief In California.

From prorfety.blogspot.com

How To Apply For Senior Property Tax Exemption In California PRORFETY Property Tax Relief In California The california constitution provides a $7,000 reduction in the taxable value for a qualifying owner. Web the california mortgage relief program uses federal homeowner assistance funds to help homeowners. Web disaster relief information — property owners affected by the thompson, gold complex, park, and borel fires may be. Property tax postponement, available for older. Web the state controller’s property tax. Property Tax Relief In California.

From prorfety.blogspot.com

How To Apply For Senior Property Tax Exemption In California PRORFETY Property Tax Relief In California Property tax postponement, available for older. Web there are two main methods (per laws known as proposition 13, proposition 58, and proposition 19 ). Web disaster relief information — property owners affected by the thompson, gold complex, park, and borel fires may be. Web the state controller’s property tax postponement program allows homeowners who are seniors, are blind, or have. Property Tax Relief In California.

From www.financialsamurai.com

Historical Gift Tax Exclusion Amounts Be A Rich Strategic Giver Property Tax Relief In California Web disaster relief information — property owners affected by the thompson, gold complex, park, and borel fires may be. Web the state controller’s property tax postponement program allows homeowners who are seniors, are blind, or have a disability to defer current. Web there are two main methods (per laws known as proposition 13, proposition 58, and proposition 19 ). Web. Property Tax Relief In California.

From www.propertytax.lacounty.gov

Annual Secured Property Tax Information Statement Los Angeles County Property Tax Relief In California The california constitution provides a $7,000 reduction in the taxable value for a qualifying owner. Web disaster relief information — property owners affected by the thompson, gold complex, park, and borel fires may be. Web there are two main methods (per laws known as proposition 13, proposition 58, and proposition 19 ). Web the california mortgage relief program uses federal. Property Tax Relief In California.

From www.signnow.com

Property Tax Exemption for Veterans for Santa Barbara California 2018 Property Tax Relief In California Web the state controller’s property tax postponement program allows homeowners who are seniors, are blind, or have a disability to defer current. Web the california mortgage relief program uses federal homeowner assistance funds to help homeowners. The california constitution provides a $7,000 reduction in the taxable value for a qualifying owner. Thousands of california homeowners can cut their property tax. Property Tax Relief In California.